3 time saving Strategies that many Accountants do not want you to know

All business owners know time is money. Saving time means not giving away hard earned profits. The following three strategies have been successfully deployed by a number of business owners to save time (money) and it is a privilege to share them with you.

-

Make sure your Accountant is more than a Bookkeeper:

Your accountant needs to know your business well to be able to provide you with sound financial advice. Their advice should provide you with a meaningful contribution to your bottom line.

Before calling on the services of your accountant you need to be well prepared. Because one of the biggest and most time consuming parts of preparing accounts is ensuring the accuracy of them. This means checking and validating balances and ensuring there are no unaccounted for transactions. Without this assurance your accountant is unable to provide the service you expect of them.

So whatever system you are using the minimum requirement is to be able to quickly and accurately confirm your accounting records to your external bank accounts.

Ideally, you need to be able to run over your accounting records with what accountants call a “reasonable test”. This simply means taking a helicopter view of your reporting and trying to spot anything that, based on your knowledge of your business, looks out of the ordinary or “unreasonable”. This is particularly helpful in spotting things that may either require further investigation or having an explanation ready before your accountant asks the question.

Your strategy, along with your accountants should be to minimise the time, effort and cost needed to prepare appropriate and accurate accounts. This means adopting the “less is more principle” rather than the “analysis to paralysis” approach. Often we are presented with copies of accounts that go way beyond standard compliance requirements and the additional information has not been requested or even being used by the client.

Also, if your accountant identifies issues with your accounting records do not just let them fix them without your knowledge. You need to know what errors are being made so that you can avoid making them again in the future. If you do not, guess what will happen? You will likely keep making the same mistakes time and again and your accountant will have to keep finding and correcting them. Costing them valuable time and you money.

It is a very smart strategy to meet with your accountant as soon as possible after year end and before they start your books, rather than after they are finished. This does put pressure on you to perform but sometimes that is a good thing, because:

- It removes a major distraction from managing your core business

- You will beat the rush and likely get better service from your accountant

- You will be able to find out what your accountant plans to do to help you in the coming year instead of just telling you what

you did which can no longer be changed (if not convinced at that meeting that your accountant is there to help you, then maybe it is time to consider a change – times are tough, no passengers allowed). - You want to find out at that meeting who will be preparing your accounts this year. You need to confirm you are not ending up with the new junior every year.

- Once you have had that meeting, what a relief. It lifts a big weight off your shoulders and you are then free to take on the world once again.

Always remember if your accountant is a member of the Institute of Chartered Accountants of New Zealand this gives you extra protection and forms of recourse not available to you if you use someone who is not bound by their strict code of conduct.

For example if you want to you can request a fully detailed account and this can be quite enlightening as you can then see where the time is going to in the preparation of your accounts. Access to this information can often highlight areas where, together with your accountant’s assistance, changes can be made to reduce that time in the future.

If the cost of your fees becomes an issue for you, or more importantly where your fee is or is likely to be significantly greater than you might expect, your accountant is required to discuss it with you before the bill is prepared. Failure to comply with these requirements allows you to file a complaint to the Institute.

Appendix 1 provides additional details for what you need to provide your accountant at year end to help them assist you.

-

Grooming your Business for Sale:

Be well prepared in advance to sell your business, as you never know exactly when the time will come that you will have to sell. When that time does arrive and sometimes this is unexpected, many owners will rely on their annual accounts to try and help them sell their business. Many of these owners will also naïvely think that that is the only honest and genuine way to present the results of their business.

Although your annual accounts are perfect for complying with the Inland Revenue they are often not that helpful when talking to a prospective buyer. Why is that? Well when you accountant prepares your standard financial accounts they should be determined to claim every single cost that can be legitimately claimed for tax purposes which results in the poorest possible result in order to minimise the tax you have to pay. For the Revenue that is the perfect result but it has the effect of dressing your business up like it is going out to a funeral. That is not the appearance you want to present when you have a hot prospect interested in you. You want to appear as if you are going out to an important occasion or a party. Now you don’t want to put on any false appearances but you do want to do everything possible to present an honest and genuine look that will help them make a quick and informed decision about your business.

That actually means you need to remove stuff that will get in the way of the buyer making an informed decision.For example, no two owners given the same business to operate will ever produce the same taxable result. Why? Because they will never make the same decisions over certain discretionary costs and their circumstances will be different. Therefore, when selling your business don’t spend all the time sharing with them the great job you did in the past but rather assist them to see how business can be great for them in the future. That means legitimately removing certain costs from your current financials and allowing the prospective owner to easily insert their own.

By having this method of reporting set up well before you want to sell will give you a totally different perspective on your business on an on-going basis.

With proper guidance and training you can be prepared to help a buyer at a moment’s notice when you need to sell. The problem is if you do not plan for this early enough, you will not be able to quickly perform this process easily and efficiently. In fact we have found there is a certain mind set the seller has to adopt in order to be successful at this process.

here is also the risk that unless you can easily get your hands on reliable information you might feel forced into agreeing to guarantee the performance of the business just to sell it. Then through no fault of your own, you end up carrying future risks and costs.

You will also avoid the situation we have seen on a number of occasions where the client asks the accountant to prepare an adjusted set of accounts during the year at the request of an interested party. The client bears that cost which may involve them in fees from $500-$2,000 and the deal goes cold. Six months later someone new comes along and similar costs are incurred again. This strategy is designed to try and minimise those costs. In making these suggestions we are not suggesting you exclude your accountant, we are simply saying use their skills and expertise to verify your information, not prepare it.

-

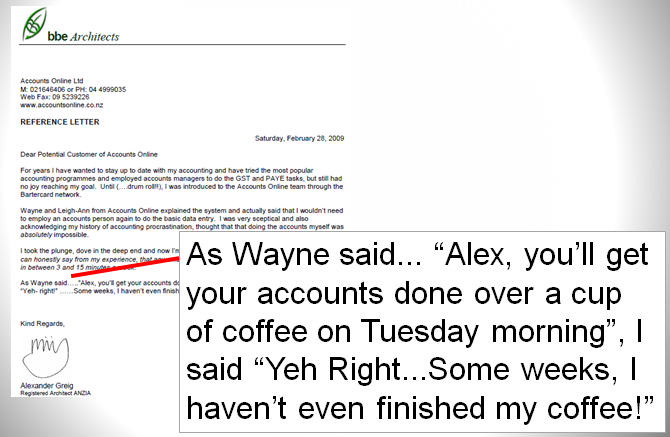

Time Saving Software

The final strategy involves examining the type of tools you are using to easily achieve the above two strategies. Experience has taught us that success in these areas depends on having the right tools for the right job. What you might not be aware of is that thousands of accountants throughout NZ and Australia use a special piece of software that you cannot purchase online or from a retailer like Harvey Norman or Dick Smiths. They use this software to efficiently process their clients’ accounts and most clients have no knowledge of this best kept secret. Here are the comments of a couple of accounting firms who use it:

” BankLink delivers data to us so quickly and seamlessly, which gives us a real head start in processing GST returns for the month.” McGreevy & Associates Ltd

” Big savings despite low transaction volumes. LAQC clients are usually looking for rapid refunds, and BankLink Practice helps us turn their accounts around very quickly. We receive the data automatically so there’s no waiting around for statements.” Tony Thorne, Partner Thorne Accounting

There is simply nothing faster out there to process accounting records! If we said to you there is an opportunity for you personally to enjoy those same savings would that be of interest to you? What that would mean is that you would then be in a position to make better use of your accountant’s service but at a much higher level for the same or in some cases less money than you were paying before.

In other words you employ your accountant for their technical skills and get them to help you with more of the strategic stuff that adds real value to your business? Besides, accountants prefer that interesting work……and also never forget that your accountant works for you, not the other way around.By accepting more control there is an added benefit. If you allow your accountant’s office to do all your bookwork, who is keeping an eye on their workmanship? The reason we ask that question is because, full accountability with Inland Revenue falls on you as the tax payer, not on your accountant.

We have in our files many instances where accounting firms, who have relied on their junior staff to do a good job, have failed. By

giving you direct access to this professional software…. means you can be trained to be in the driver’s seat of your accounts, not in the passengers. It then means your accountants are given the opportunity to perform more of a review function of your core accounting records rather than a preparing one.After being trained to use this software if you get stuck on how to handle a certain transaction, then you consult your accountant or us. Because, it is most important to deal with any sticking points while they are fresh in your mind and when the information is readily available. Plus, you learn from the experience.

After being trained to use this software if you get stuck on how to handle a certain transaction, then you consult your accountant or us. Because, it is most important to deal with any sticking points while they are fresh in your mind and when the information is readily available. Plus, you learn from the experience. https://www.kmworld.com/articles/news/news-analysis/the-high-cost-of-interruptions-14543.aspx

If any of the above strategies appears a little challenging remember the words of Julie Woods, a great lady from Dunedin who cannot see. She wrote:

“Asking for help is not an act of dependence; it’s the key to independence”.

She wrote that in her inspirational little book entitled “How to make a Silver Lining”. If you would like a copy please request one from info@accountsonline.co.nz – it’s brilliant.

One of our associates said it made her cry, laugh and made her think I don’t have much to complain about.

In conclusion these three strategies set you up for:

- Now – a better way to save time and be more in control of your business on a

daily basis - Year End – a more efficient way to get your end of year accounts processed and to

make real good use of your accountant’s skills, expertise and knowledge - Future – a streamlined approach to selling your business when the time arrives

(and no owner knows that precise moment)

Offer to YOU:

If you want help to implement any of the above strategies please book a FREE 1 hour session valued at $150.00 plus GST. There could be hidden gold in your business. To book either email: info@accountsonline.co.nz or call 04 4999035 If you introduce a friend(s) and they join our service you will receive a surprise valued at $120! Please pass on this valuable information and help someone you know in business or starting out.

Appendix A – Help Yourself and your accountant at year end

If you use the BankLink software you will save yourself and your accountant lots of valuable time when completing the following year end tasks:

- Provide your accountant with early access to your accounting records

- Photocopy your closing bank statement, credit card, or financial institution pages as at your year-end e.g. 31/3

- Photocopy any loan statements as at year end and ensure that it shows the interest paid for the year

- Photocopy any hire purchase statements as at year end showing the interest paid

- If you still write cheques out, it is important at year end within the software (prior to doing your final GST return) to do your unpresented cheques (UPCs). This will take you less than a minute to do in the software. No ticking or reconciling!

- Print the Bank reconciliation report off and verify and attach your closing bank statement(s) page of the year

- Ensure that if you have more than one bank account tracking or credit card tracking that your “transfer between bank accounts account

balances to Zero” - Ensure that in the software you have typed a narration against any Assets (greater than $500 plus GST) you have purchased e.g. Ford Mondeo Regn#: BTD385. This assists your accountant because they can take ledger reports out of the software to excel and import these additions into their asset registers – saving more time

- Any donations made should have a narration e.g. Canteen, or World vision

- Any large repairs and maintenance should have a narration typed as to what work was carried out e.g. replaced guttering

- If you have multiple entities i.e. trusts, partnerships and companies that you transfer money to and from, then the intercompany accounts must balance

- Provide an outstanding debtors (people that owe you money) aged trial balance listing as at year end

- Provide an outstanding creditors (people that you owe money to) list by supplier, code and amount. If you have a lot of creditors to manage we recommend a web based creditors product called CRED-it that will save you time and dollars and your accountant can access it so they do not have to interrupt you at year end

- Ensure that your GST payments/refunds ledger report agrees to your GST returns.

Tips:

- Do not send all your bank statements, cheque butts and invoices to your accountant to reprocess.

- If you are rekeying your bank statement data into a spreadsheet or other accounting systems then you are wasting valuable time, and no doubt your accountant or their staff will re-enter the information into their accounting system – and guess who pays?